TAX INFORMATION

Understanding the Tax Rate

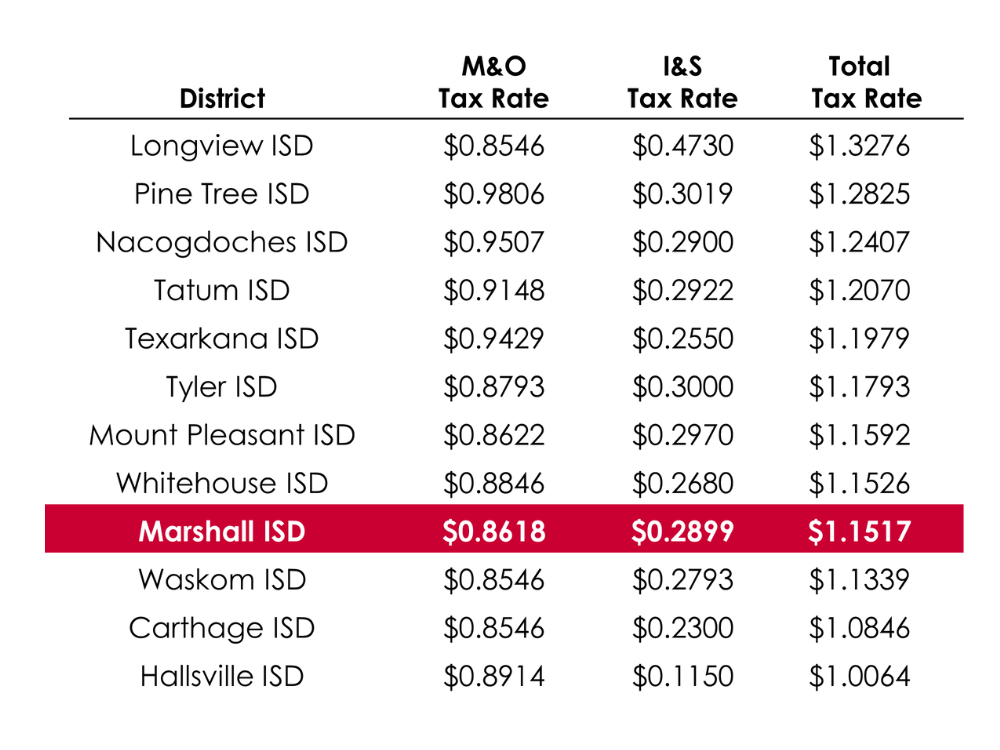

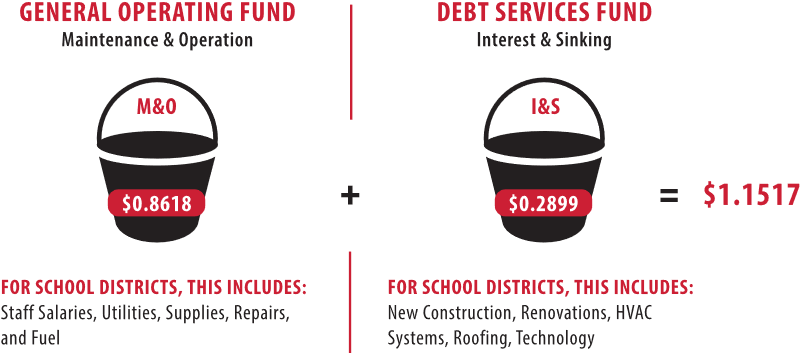

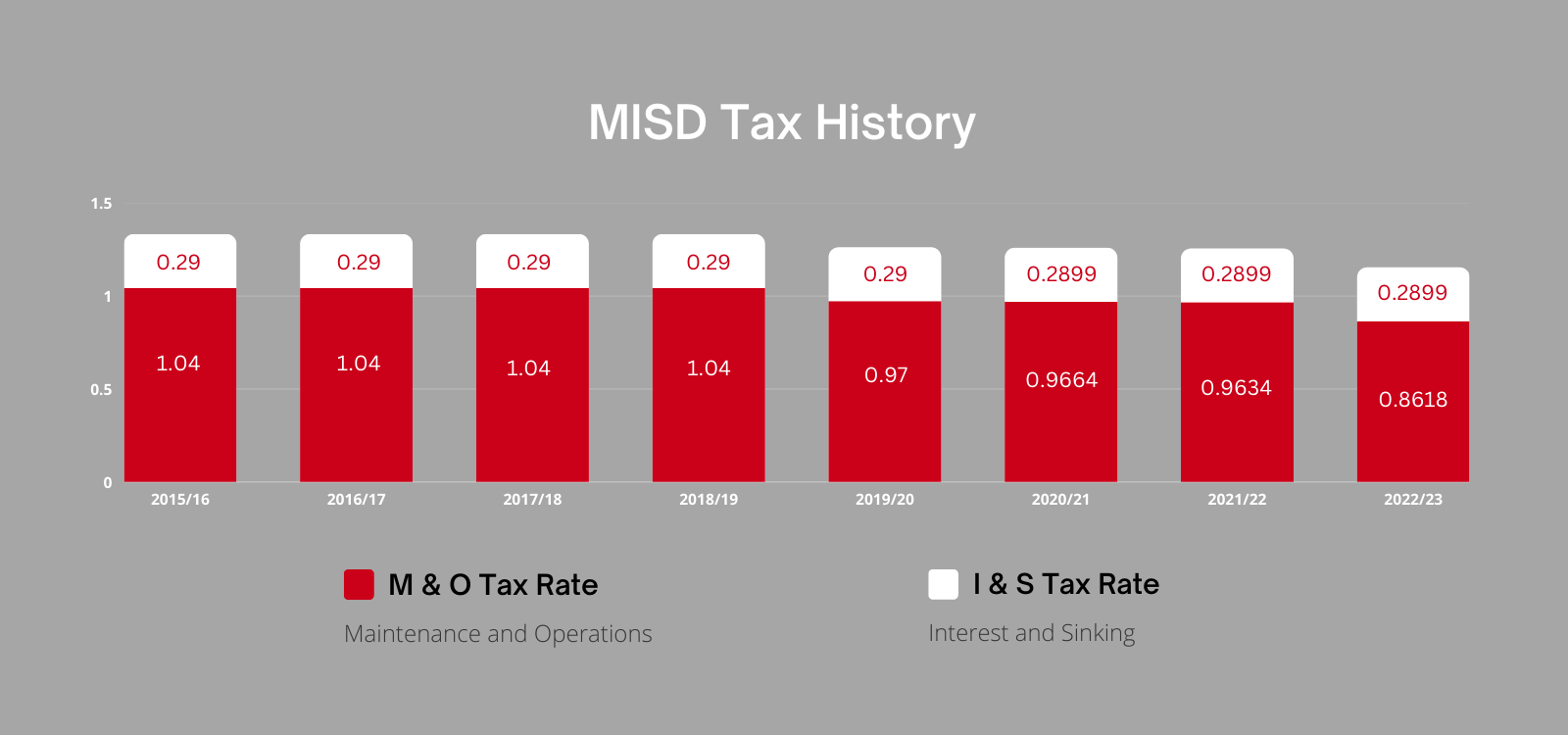

A school district's total tax rate is made up of two parts, which divide the school district budget into two “buckets” - the maintenance and operations (M&O) rate and the interest and sinking (I&S) rate. Each has a designated purpose and budget.

M&O Tax Rate vs. I&S Tax Rate

The M&O budget is used for daily operations of the district, including utilities, salaries, supplies, repairs, and fuel.

The I&S budget is used to repay debt for capital improvements through voter-approved bonds. These improvements include new construction, renovations, HVAC and roofing replacements, land purchase, furniture, and technology.

Bond elections only affect the I&S tax rate. Funds from a bond CANNOT be used as part of the M&O budget or to increase salaries.

How Does the Bond Impact Taxes?

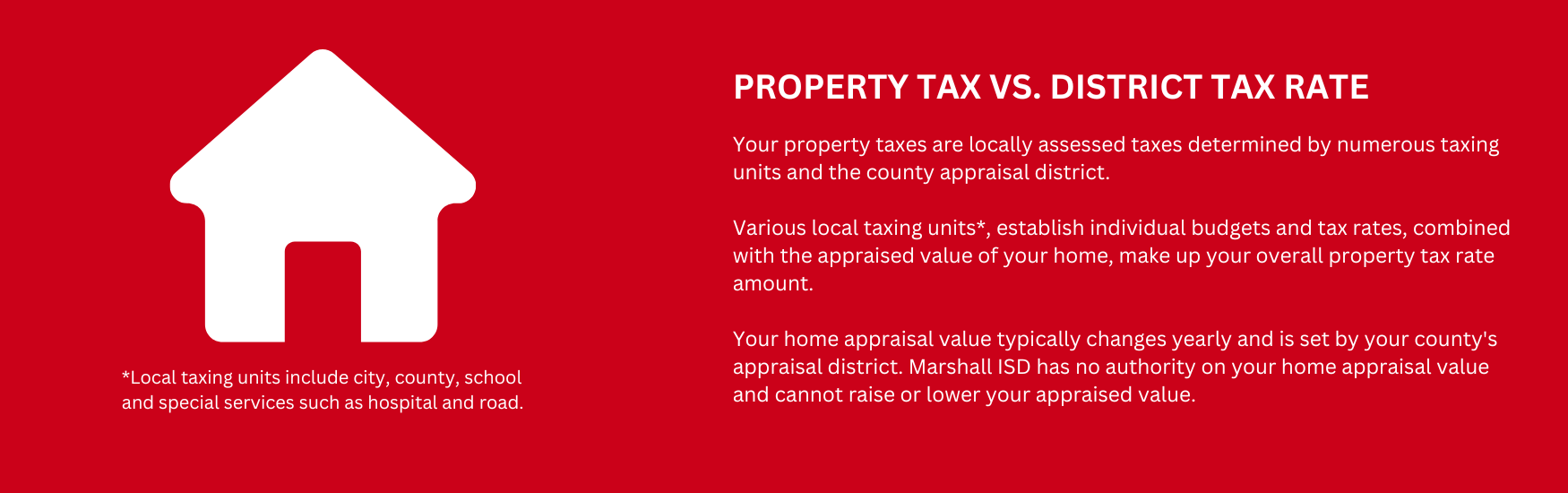

Due to the good financial stewardship of the Marshall Independent School District and the Board of Trustees, Marshall ISD residents will not see an increase to their property taxes from the school district if the bond were to pass.

The Marshall ISD total tax rate WILL NOT INCREASE as a result of this bond.

TAX RATE COMPARISON